rhode island income tax nexus

Foreign Limited Liability Partnership LLP - RI. Detailed Rhode Island state income tax rates and brackets are available on.

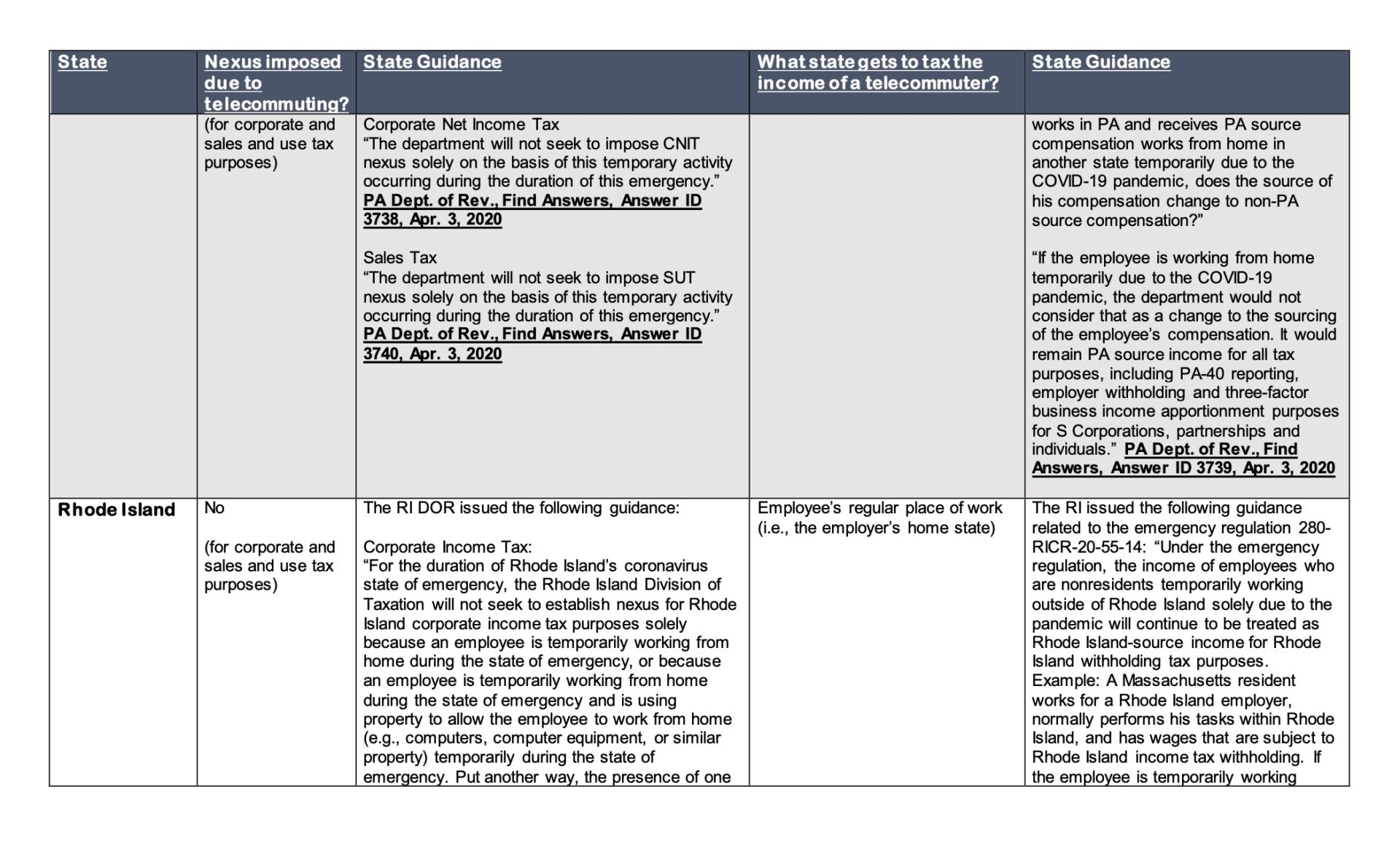

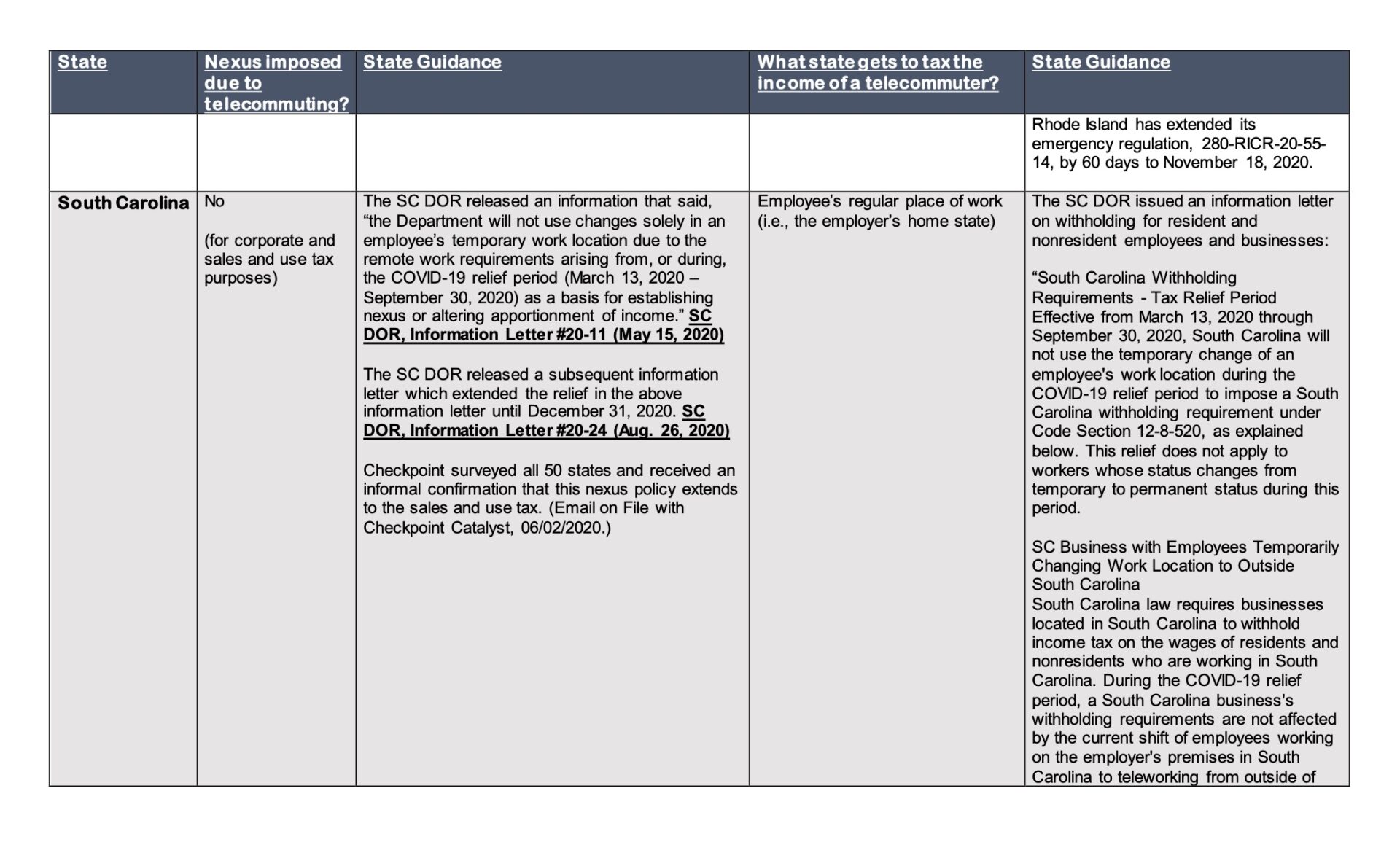

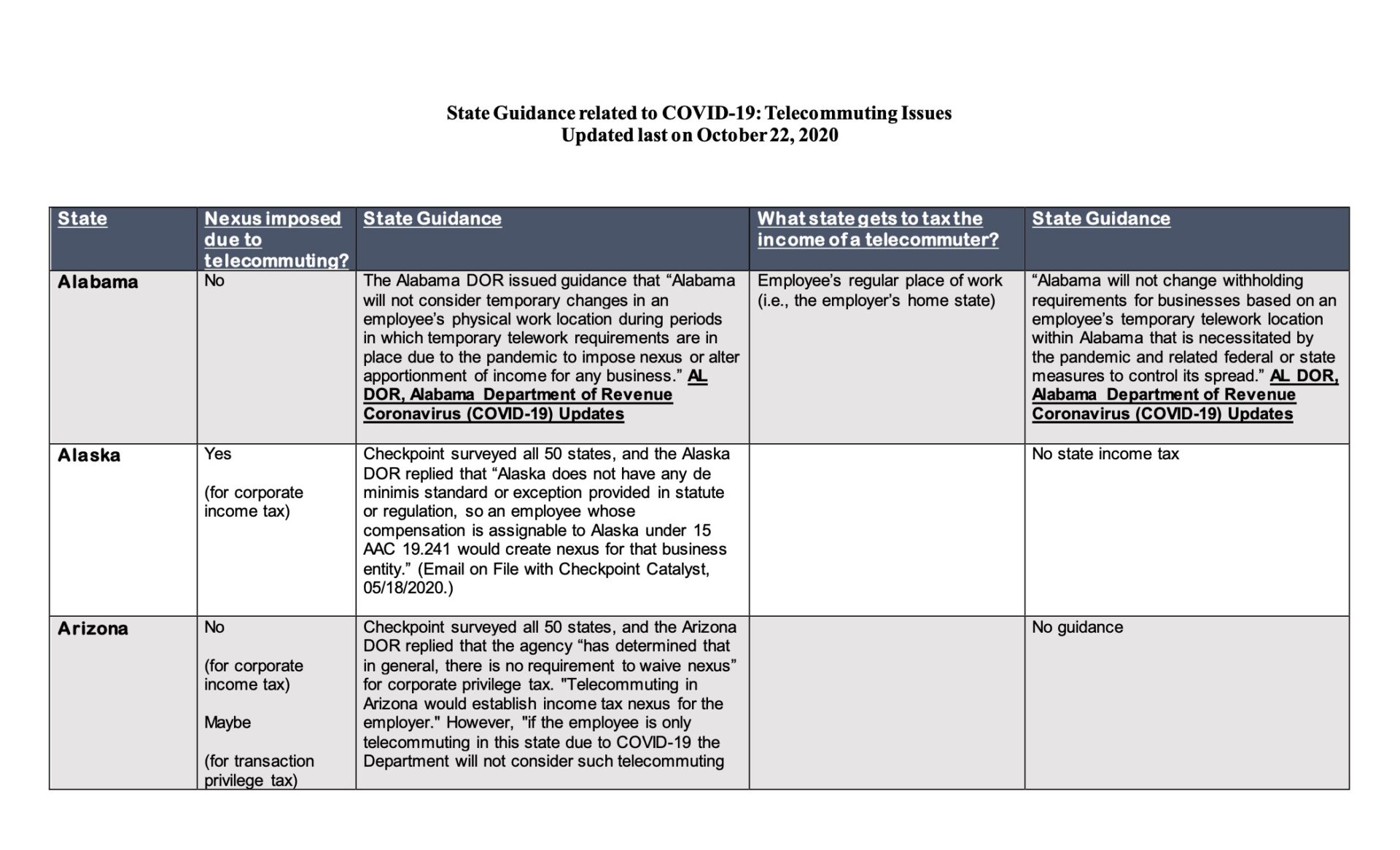

2021 State Income Tax Nexus For Telecommuters Wolters Kluwer

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children. In addition the performance of any services by.

This amendment provides guidance regarding Nexus for Business. For the duration of rhode islands coronavirus state of emergency the rhode island division of taxation will not seek to establish nexus for rhode island corporate income tax purposes solely. 2022 Child Tax Rebate Program In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per.

RI-1040 can be eFiled or a paper copy can be filed via mail. The purpose of this regulation is to implement Rhode Island General Laws RIGL Sections 44-11-4 and 44-11-41. Form RI-1040 is the general income tax return for Rhode Island residents.

85 Definitions 86 Nexus - Generally 87 Corporations Subject to Taxation - Generally 88 Combined Reporting Requirement for C-corporations and Combined Groups - Factor-Based. In light of the foregoing the following activities shall be considered protected activities for purposes of corporate income tax nexus in this State. Rhode Island recently enacted changes to corporate tax requirements that include updated guidance for corporate nexus combined reporting single sales factor apportionment and.

An annual minimum corporate tax of 400 applies to all business entities required to register to do business in Rhode Island. For the duration of rhode islands covid-19 state of emergency the department will not seek to establish nexus for rhode island corporate income tax purposes solely because an employee is. 86Nexus Generally 87Corporations Subject to Taxation Generally 88Combined Reporting Requirement for C-corporations and Combined Groups Factor-Based Nexus Approach for.

This Rule describes activities that are sufficient for creating corporate income tax. Such in-state presence andor activity will not in and of itself trigger nexus for Rhode Island corporate income tax purposes. Personal Income Tax A personal income tax is imposed for each taxable year which is the same as the taxable year for federal income tax purposes on the Rhode Island.

2022 Child Tax Rebate Program In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per. 1 Soliciting orders for sales of tangible. Current through July 5 2022 Section 280-RICR-20-25-810 - Activities that Create Nexus A.

Generally a business has nexus in Rhode Island when it has a physical presence there such as a retail store warehouse inventory or the regular presence of traveling salespeople or. Laws 7-12-59 Establishing Nexus In general terms nexus means that a business has sufficient connection or presence in RI for. To calculate the Rhode Island taxable income the statute starts with Federal taxable income.

On August 3 2017 Rhode Island enacted affiliate and economic nexus with an alternative reporting requirement structure for those remote sellers that do not collect Rhode. 11-0001 Form RI-1040ES - Estimated Individual Income. Corporate income is taxed at a single rate of 7.

Rhode Island Division Of Taxation 2018 Filing Season Presentation Ppt Download

A State By State Guide To Economic Nexus

.jpeg)

Sales Tax By State Economic Nexus State Guide Doola Blog

State Guidance On Whether Covid 19 Telecommuters Create Nexus Salazar Cpa

State Guidance On Whether Covid 19 Telecommuters Create Nexus Salazar Cpa

Tcja State Tax Impact Simekscott

Wayfair State Tax Update Forvis

Rhode Island Sales Tax Small Business Guide Truic

Corporate Income And Franchise Taxes In Rhode Island Lexology

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

How Do State And Local Sales Taxes Work Tax Policy Center

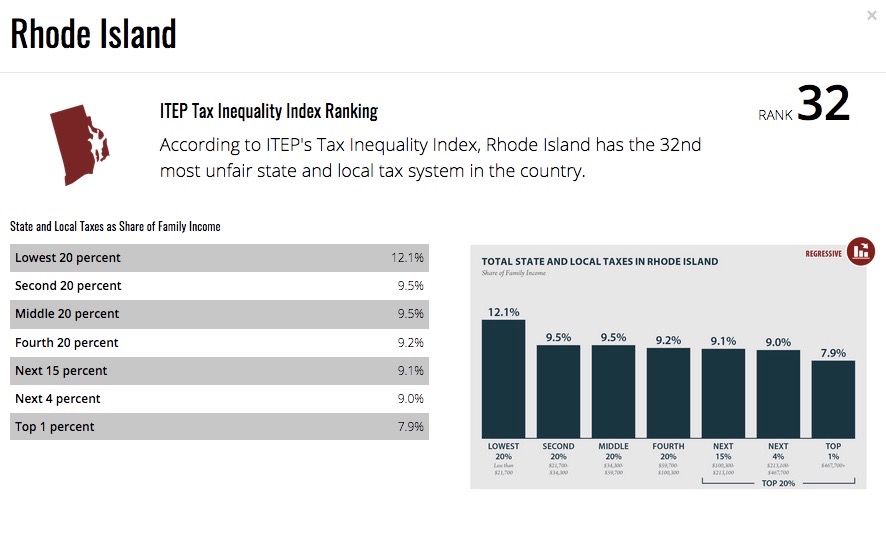

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

State Guidance On Whether Covid 19 Telecommuters Create Nexus Salazar Cpa

Navigating The Nexus How To Handle Sales And Use Tax Lab 916

Economic Nexus Reporting Requirements Reference Table Wipfli

Nexus Tax Trials And Tribulations Of A Remote Workforce Doeren Mayhew Cpas